Can Payroll Taxes Be Deferred Under The Cares Act

Deferred tax liability is to be paid in two installmentswith. CARES Act allows employers to defer employer portion of Social Security payroll taxes.

2021 Federal Payroll Tax Rates Abacus Payroll

If deferred the employer owes 50 of the deferred amount by December 31 2021 and the remaining 50 by December 31 2022.

Can payroll taxes be deferred under the cares act. Half of the deferred amount is due on December 31 2021 and the other half is. Section 2302 a 2 of the CARES Act provides that deposits of the employers share of Social Security tax that would otherwise be required to be made during the payroll deferral period may be deferred until the applicable date. However the CARES Act was recently amended to allow employers to continue to defer Social Security tax deposits after the PPP loan is forgiven which greatly expands the amount of Social Security taxes.

Eligible employers using this program will have until Dec. As originally enacted the CARES Act required employers who received a Paycheck Protection Program PPP loan to stop deferring the Social Security tax after receiving notification of loan forgiveness. This content is for the first stimulus relief package The Coronavirus Aid Relief and Economic Security Act CARES Act which was signed into law in March 2020.

The CARES Act does however outline tax deferrals in an equivalent amount for self-employed individuals subject to the Self. While the CARES Act was helpful with immediate guidance a number of questions remained outstanding. The Act allows for deferral of the employer portion of Social Security tax imposed by IRC.

Deferral does not apply to employee income tax withholding the employee or employer portion of the Medicare tax or the employee portion of the Social Security tax. There is no dollar cap on the total amount of an employers social security taxes that can be deferred. 31 2021 and deposit the remaining 50 percent deferral by Dec.

The short answer is yes The CARES Act employer payroll tax deferral was not a grant nor was it a forgivable loan like some of the other COVID-19 tax relief for business owners. The Social Security Trust Funds will be held harmless under this provision. The CARES Act contained a delay in payment of employer payroll taxes as opposed to the employees share of payroll taxes.

In particular questions remained with regard to the interaction of the deferral. There are no employer eligibility requirements with respect to Deferral. 31 2020 and to pay the deferred taxes in two installments the first half is due Dec.

The payroll tax deferral period begins on March 27 2020 and ends December 31 2020. Under the CARES Act 50 of any taxes eligible for deferral are due on December 31 2021 and the remaining 50 of such taxes are due on December 31 2022 each such due date the Applicable Due Date. Borrowers With Forgiven PPP Loans Can Defer Payroll Tax Deposits Section 2302 of the CARES Act provides that through December 31 2020 employers may defer the deposit and payment of the employers portion of Social Security taxes and certain railroad retirement taxes.

The CARES Act allowed employers the opportunity to defer payment of the employer portion of FICA taxes 62 for any payroll paid between March 27 2020 and Dec. 31 2021 to pay 50 of the deferred employer taxes and the remaining 50 is due on Dec. All employers should work with their payroll provider payroll departments or payroll software to immediately begin deferring these employer Social Security taxes.

Therefore any employer using a third-party payroll provider or agent should work closely. The only possible exception is employers that are applying for the Small Business. In general all employers are eligible to defer payroll taxes.

To give people a needed temporary financial boost the Coronavirus Aid Relief and Economic Security Act allowed employers to defer payment of the employers share of Social Security tax. 116-136 allows employers to defer the payment of the employer share of Social Security or Railroad Retirement payroll taxes otherwise required to be deposited between March 27 and Dec. Section 2302 of the CARES Act provides that through December 31 2020 employers may defer the deposit and payment of the employers portion of Social Security tax and certain railroad retirement taxes.

Payroll taxes that can be deferred include the employer portion of FICA taxes the employer and employee representative portion of Railroad Retirement taxes that are attributable to the employer FICA rate and half of SECA tax. The CARES Act requires that the employer not the payroll service provider is responsible for ensuring the deferred payroll tax is remitted timely by the applicable deferral date. 31 2021 and the remainder by.

Specifically the CARES Act deferred employer OASDI payroll taxes due between March 27 2020 and December 31 2020. Section 2302 of the Coronavirus Aid Relief and Economic Security CARES Act PL. The company could instead deposit 50 percent of the deferred amount by Dec.

Its important to note that the CARES Act does not cover other payroll taxes such as the Medicare tax 145 percent or the employees share of the social security tax. The CARES Act allows employers to defer payment for the employer portion of payroll taxes62 for Social Security taxesdue from March 27 2020 through December 31 2020. Under the CARES Act the employer could refrain from depositing the employers 62 percent tax accruing on or after April 1 2020 through Dec.

This delayed due date amounts to an interest-free loan for employers providing the. IRS Notice 2020-65 PDF allowed employers to defer withholding and payment of the employees Social Security taxes on certain wages paid in calendar year 2020.

Payroll Tax Deferral Under The Cares Act Maryland Nonprofits

Payroll Tax Deferral How Will It Affect You Experian

Tax Deduction Impacted By Payroll Tax Deferral Grant Thornton

These 70 Employers Opted Out Of Trump S Payroll Tax Deferral Did Yours

Us Deferral Of Employer Payroll Taxes Help Center

Payroll Tax What It Is How To Calculate It Bench Accounting

The True Cost To Hire An Employee In Texas Infographic

Us Deferral Of Employer Payroll Taxes Help Center

Cares Act Payroll Tax Deferral For Employers

Payroll Tax Deferral Deferred Payments Can Lead To Deferred Tax Deductions Explore Our Thinking Plante Moran

A Reckoning For Payroll Tax Deferrals Journal Of Accountancy

Payroll Tax Deferral Starts Today

Why You Won T See A Payroll Tax Cut In Second Stimulus Round

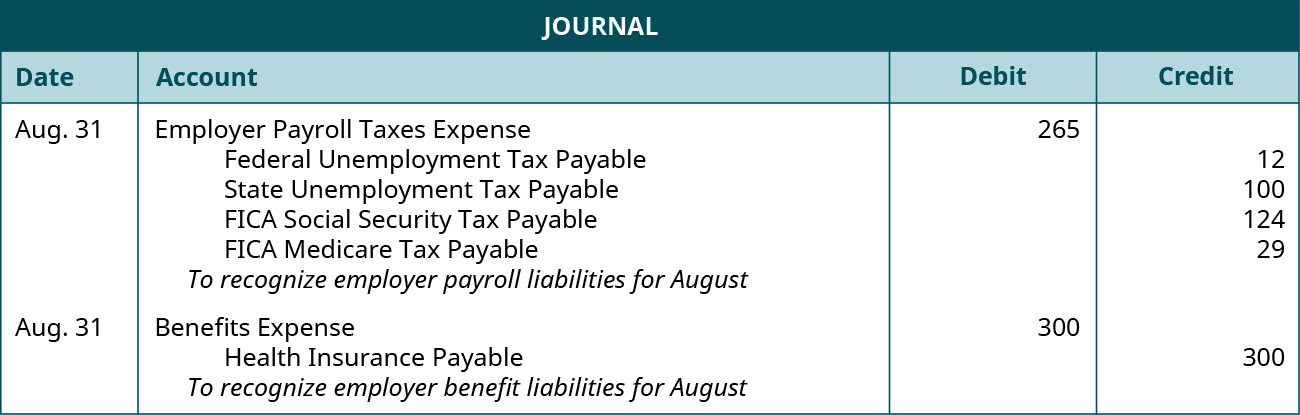

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Irs Defers Employee Payroll Taxes Jones Day

Https Nfc Usda Gov Clientservices Hr Payroll Docs Payroll Tax Deferral Faqs Pdf

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Post a Comment for "Can Payroll Taxes Be Deferred Under The Cares Act"